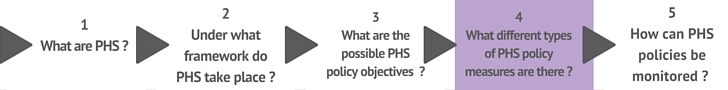

A tool to identify the types of measures to be implemented

In this section, we provide guidance for the selection of types of measures to be implemented. It is important to note that identification of the relevant measures will depend on the context and objective of each country/region. In that regard, we do not provide a ready answer on the ideal policy to be implemented in a given area; rather, we help policymakers to consider every crucial aspect when they are designing a specific policy, step by step, together with the implications of those aspects.

Table 8: Tool to identify the types of measures to be implemented step by step

|

Key aspects to analysed |

Questions to be raised |

Implications |

|

Step 1: The objectives of the measure |

||

|

See tool for identifying possible main objectives in part 3. |

||

|

Step 2: The scope of the measure |

||

| What should be the scope of the measure (who or what are the targeted workers, users, activities)? | Do I want to reach a specific group of workers (when increasing employment)? | The answer to this question will help to determine whether the measure will have specific features or not with regard to worker types. For example, reduction in company taxes might be allowed for only some types of workers (i.e. the long-term unemployed) |

| Do I want to reach a specific group of users? | If a policymaker wants to reach a specific group of users, targeted demand-side support will be necessary (e.g. social subsidies targeted to households with low revenues). | |

| What types of activities do I want to be covered by the measure? | This will be strongly related to the main objective of the measure. If one considers a measure on only one specific type of service (e.g. childcare), this must be taken into account when designing the policy. For example, regarding children, rofessionalisation will be very important, as will affordability (to fight inequality). Therefore measures for both the demand and the supply side could be considered. | |

|

Step 3: The type of intervention of the measure |

||

| Should I reduce the price for users? | Is the formal market currently affordable, including for lower incomes? | If it is not, lowering prices might be a key objective. Several measures should be considered, but specific focus should be put on equity. Specifically, the design of the policy should take into account the fact that support for those with lower incomes is needed: in this respect, a sole tax deduction would not lead to a significant increase in demand for lower incomes. It must then be combined with other support forms that ensure that the direct price of services is accessible to those with lower incomes. One might also pay particular attention to deadweight effects: the support provided should effectively help people with lower incomes to access services and should not only allow people to benefit from subsidies/tax deduction on services that they would have bought anyway. |

| Is the demand price-elastic? | If not, reducing the price will not change much with regard to demand. One might then consider improving quality, reducing administrative burdens, and so on. | |

| Is the undeclared market appealing for users (price)? | If it is, consider implementing measures to reduce prices in the formal market (demand supports and/or supply supports) and measures to combat social acceptance of undeclared work (see below). | |

| Should I reduce costs for services providers? | Are the costs to produce PHS such that the production of those services would not be profitable for services providers or would be provided at too high a price? | If they are, one could support the supply side by implementing measures to reduce the cost of providing the services. They could pay attention specifically to labour costs that represent most of the costs of the services. |

| Should I implement measures to increase quality in the PHS sector? | Is the undeclared market appealing for users (quality)? | If the difference between quality in the undeclared market and quality in the formal market is not high enough, implementing measures to increase quality in the formal market might be necessary. |

| Does the current formal market offer a sufficiently high quality/professionalisation to support the development of the market? | If it does not, one might consider the implementation of certification and training courses. In that respect, a system based on a triangulation (PHS workers employed by organisations instead of being directly employed by users) might facilitate the professionalisation of the market. | |

| Regardless of price and quality, should I make the formal market more attractive, relatively-speaking?

|

Is undeclared market socially accepted? | If undeclared work is widely accepted socially, decreasing the price of formal services might not be sufficient. Then policymakers could consider communication campaigns to raise awareness on the illegality and dangers of undeclared work. The responsibilities and duties of PHS employers should also be stressed to ensure that they understand what they may encounter and what the risks are when they depend on undeclared economy. |

| Is the existence of the formal system sufficiently known in the population? | If it is not, one should consider communication campaigns to promote the formal system. | |

| Are transactions in the formal market simple enough (in comparison to the undeclared market)? | If they are not, one should consider simplifying the system and reducing, for instance, administrative burden on users. | |

| Should I facilitate/foster employment in PHS sectors? | Do PHS services providers have difficulties hiring PHS workers? | If they do, one might think of implementing policies that facilitate employment by PHS providers (new regulation on employment, etc.). |

| Are the declared jobs attractive enough to ensure the development of the sector? | If they do not, one might consider schemes to improve professionalisation and working conditions. In that respect, triangulations (as opposed to direct employment by users) might facilitate the development of better working conditions, training courses, etc. One might also consider putting in place specific statuses for employees that ensure them sufficient employment security but also offer employers sufficient flexibility. Ideally, designing that framework in coordination with social partners should be considered. | |

| Should I enhance accessibility and/or support matching between the demand and the supply? | Are the service providers easily accessible (geographically)? | If they are not, the design of the policy will have to take into account the need for open competition, easier access to agreements, etc. |

| Does demand easily match supply? | If it does not, it might be the case that several obstacles exist in the matching of demand and supply (e.g. supply side not easily accessible, match between demand and supply not centralised, complicated procedures when it comes to accessing the services, etc.). In this view, one could consider simplify procedures, for example, through digitalisation of the system introduction of a general voucher system. | |

|

Step 4: The price reduction and settlement system |

||

| What tool should be used to implement a price reduction policy? | Do the different aspects of the desired policy imply that it would be implemented more efficiently through allocation in cash, in kind or through a voucher system? | Depending on the measures selected (tax reduction, presence of intermediaries, etc.) and the national context one might consider the whole range of tools. They can also be combined in the same intervention. |

| What should the price of PHS be? | What is the average price on the undeclared market in comparison to the price of the formal provision of services? | If the average price in the undeclared market is too low, a reduction in formal price might be necessary. This might be done through price reduction mechanisms (demand side) such as subsidy, tax deductions, etc. but it could also be complemented with supply side-supports with a view to decreasing prices and improve quality (e.g. we might consider opening the market up to competition or providing agreements to ensure sufficient quality). It is important to ensure that the price of formal provision is competitive in comparison to the price on the undeclared market. |

|

Step 5: Specific features of the PHS measure |

||

| What type of service providers should I promote? | Given the needs in terms of, among others, accessibility and sustainability, does the integration of private companies need to be encouraged and does competition in the sector need to be opened up? | Depending on the objectives and context, one could consider opening up the market to several organisations (whether private for-profit, private not-for-profit or public) in order to widen the market, decrease public cost, etc. The public authority might still play a key role in distributing agreements, and so on, to ensure the quality of services. |

| What type of employment relationship should I promote? | Given the needs in terms of, among others, quality of services and working conditions, should I foster employment relationships based on a triangular form of employment instead of a bilateral relationship or both (leaving the choice to the beneficiary)? | Depending on the objectives and context, one might evaluate which type of relationship best matches its expectations. Both types of relationship can also be allowed at the same time, as it is the case in France and in Finland. |

| What should the role of the public authority be? | In which specific aspects of the system should the national authority play a role? | Depending on the answers to previous questions, one might have a clearer idea of the possible role of the national authority. Specifically, the national authority might undertake the following roles: direct provision of services, intermediary between private organisations and users with a view to meeting demand, quality controller, monitoring of the system. The role of the national authority will depend on the objectives, context and budget available. It must be pointed out that direct provision of the services might be costly and a role as intermediary might result in lower expenses for the national authority. |

|

Step 6: Funding the measure |

||

| What should the potential available and invested budget be? | What should the level of public intervention in PHS be? | One should set a contribution that covers the difference between the total cost of the services for the service provider (mostly made up of labour costs) and the willingness of users to pay for declared services (taking into account the existence of the undeclared market). The sustainability of funding for the measure must also be taken into account, as must its possible earn-back effects. |

| On the basis of the types of measures that you may need, do you think sufficient budget is available? | One might consider the different possibilities for “co-financing”:

„ Participation of private companies to reduce functioning costs; „ EU (through funds such as the ESF); „ Other ministries, as the measures will also affect their work. |

|